Bharat Electronics Ltd; Defence Sector; 860% returns in 5 years; Should you invest ?

Company Snapshots

- Incorporated in 1954, Bharat Electronics Ltd was formed under the Ministry of Defence to handle Indian Defense electronic needs

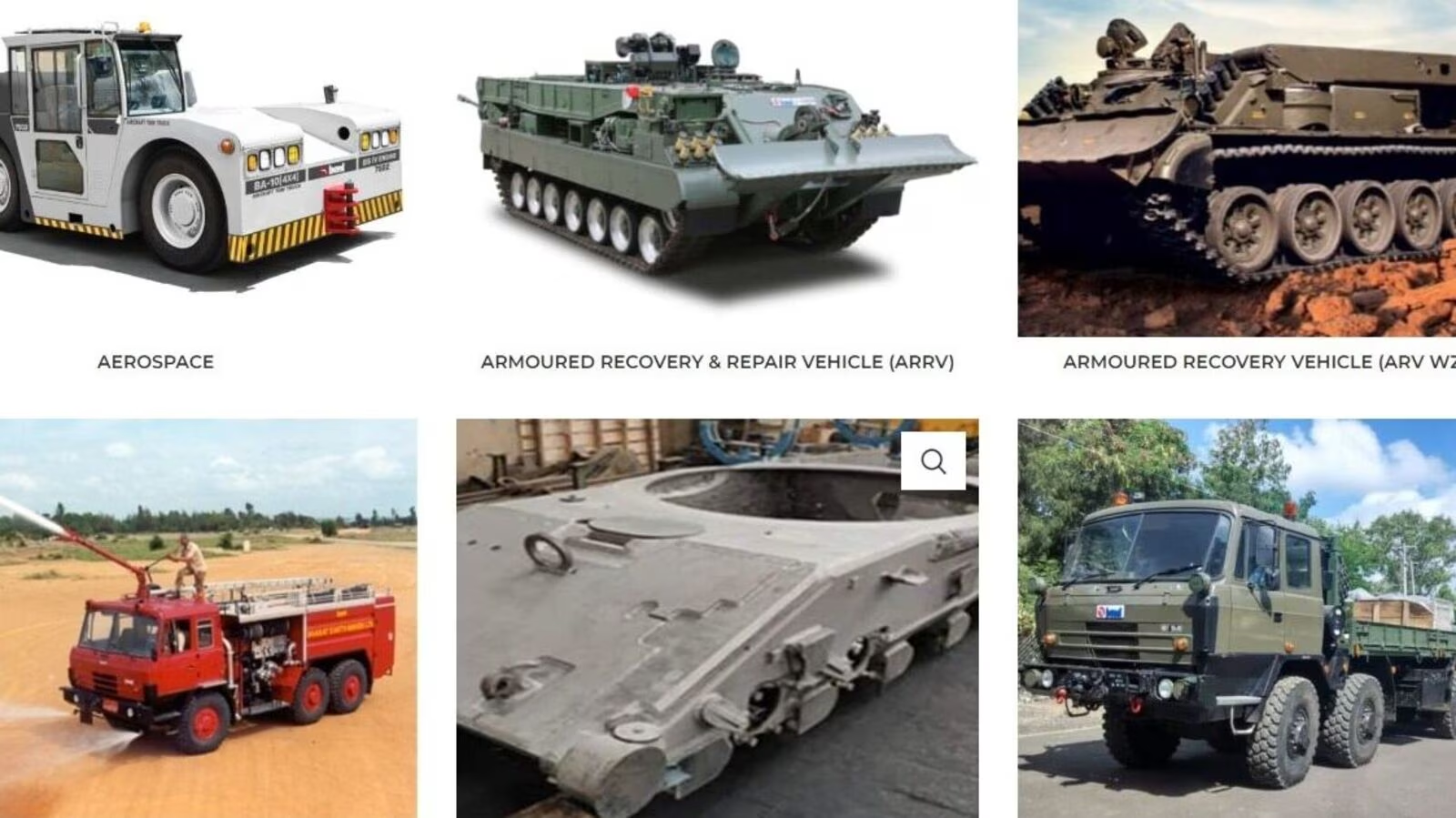

- Company manufactures and supplies electronic equipment and systems to the defence sector.

- BEL is a multi-product, multi-technology, conglomerate that provides products and systems to India’s armed forces.

Revenue Breakup

1) Defence Segment –

- 89.8% revenue comes from defence segment

- Manufactures Radars and fire Control Systems, Missile Systems, Communication and C4I systems, Electronic Warfare & Avionics, Naval Systems & Antisubmarine Warfare Systems, Electro Optics, Tank Electronics & Gun Upgrades, etc\

2) Non- Defence Segment-

- 10.2% revenue comes from the non defence segment.

- Manufactures EVM & VVPAT, provides services to Railway, Metro, space electronics, Airport solutions, etc

Fundamental Analysis

Key Ratios

| Market Cap | ₹ 2,23,606 Cr. |

| Current Price | ₹ 306 |

| High/Low | ₹ 323 / 121 |

| Stock PE | 56.1 |

| Industry PE | 75.8 |

| ROCE | 34.8 % |

| ROE | 26.4 % |

| PEG Ratio | 3.48 |

| Debt To Equity | 0.00 |

Financial Trend

Revenue: 5 Year Comparison

- 2020: 12,968

- 2024: 20,268

- 5 Year Percentage change:

Net Profit: 5 Year Comparison

- 2020: 1,824

- 2024: 3,985

- Percentage change:

Shareholding Pattern

Change in Shareholding Pattern

| Mar-23 | Mar-24 | 1 Year Change | |

| Promoters + | 51.14% | 51.14% | 0.00% |

| FIIs + | 16.42% | 17.56% | 1.14% |

| DIIs + | 25.50% | 22.63% | -2.87% |

| Public + | 6.95% | 8.66% | 1.71% |

Promoters

- Mar-23: 51.14%

- Mar-24: 51.14%

- 1 Year Change: 0.00%

- Analysis: The promoters’ shareholding has remained constant over the year, indicating no change in their ownership stake.

FIIs (Foreign Institutional Investors)

- Mar-23: 16.42%

- Mar-24: 17.56%

- 1 Year Change: +1.14%

- Analysis: FIIs have increased their stake by 1.14 percentage points, reflecting growing interest or confidence from foreign investors.

DIIs (Domestic Institutional Investors)

- Mar-23: 25.50%

- Mar-24: 22.63%

- 1 Year Change: -2.87%

- Analysis: DIIs have reduced their stake by 2.87 percentage points. This decrease could indicate a reallocation of investments or reduced confidence in the company.

Public

- Mar-23: 6.95%

- Mar-24: 8.66%

- 1 Year Change: +1.71%

- Analysis: The public shareholding has increased by 1.71 percentage points. This rise might indicate an increased interest from retail investors or a greater number of shares being available to the public.

Stock Price Returns

1 Year Stock Returns

- Bharat Electronics Limited has given 1 Year returns of 159.66 %

- 1 Lakh invested in June 2023 would have become 2.59 Lakhs in June 2024

5 Year Stock Returns

860% returns in 5 years

- Bharat Electronics Limited has given 1 Year returns of 860.15 %

- 1 Lakh invested in June 2020 would have become 9.60 Lakhs in June 2024

Bharat Electronics Limited Valuation

- Current PE- 56.1

- Median PE- 21.9

- Company is Overvalued: As the Median PE is less than the Current PE, so we can say that company is company is overvalued.

- Current Modi Government is focusing on the defence sector, this is the reason all the defence sector companies are trading at a higher valuation.

Should you Invest ?

- Bharat Electronics Ltd is a public sector company & Government has boosted the PSU sector companies & that is the reason if you are thinking of staying invested for the next 5 years then you can go ahead with this company

- Company has really strong fundamentals & the strong Revenue & Net Profit Growth over the last 5 years.

- As the BEL has the large market cap of 2.3 lakh crore in order to double up your invested money then market cap has to go to 4.6 lakh crore & which is achievable in the nest 5 years till 2029

- Do not consider investing in this company if you are looking to book small term profit

Check Out this- DCX Systems: Best Defence Sector stock invest in 2024

Disclaimer

- Money Minded School is not a SEBI registered investment advisor, Please do your own research before investing

- This article is a complete guide about Bharat Electronics Limited.

- These information and forecasts are based on our analysis, research, company fundamentals and history, experiences, and various technical analyses.

- Also, We have talked in detail about the share’s future prospects and growth potential.

- Hopefully, this information will help you in your further investment.

- If you have any further queries, please comment below. We will be happy to answer all your questions.

- If you like this information, share the article with as many people as possible

Business dicker Nice post. I learn something totally new and challenging on websites

Thanks for your words. It motivates me to move ahead.

startup talky I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

Thanks for your words. It motivates me to move ahead.

Internet Chicks I like the efforts you have put in this, regards for all the great content.

I am glad that you like it, thanks for your words. It motivates me to move ahead.

BaddieHub I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

Glad to know that you like my work

Techarp This is my first time pay a quick visit at here and i am really happy to read everthing at one place

BYU Cougars For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Insanont I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

GlobalBllog I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

FinTechZoomUs This was beautiful Admin. Thank you for your reflections.

Noodlemagazine Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated